Cryptomania: A Digital Epidemic

June 8, 2022

The world of economics is shifting. Enter cryptocurrency: a digital asset completely composed of 0’s and 1’s. Once mocked as a silly trend, its marketability has, instead, catalyzed a global switch towards digital finance.

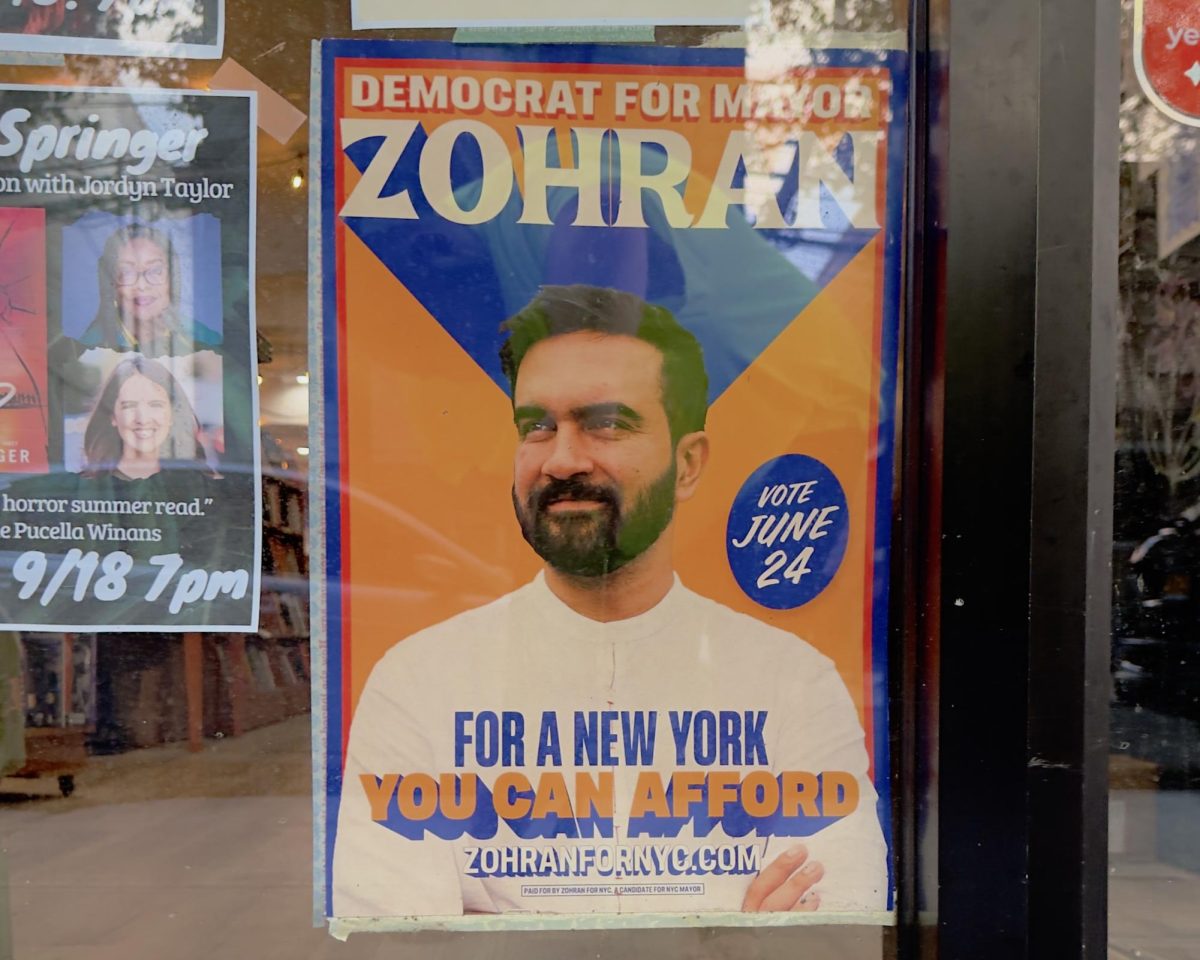

Countries such as El Salvador have adopted cryptocurrency as legal tender, while a bustling, virtual “crypto-market” houses the online sale of Bitcoin, Ether, and many other options. Many hail this as the future of money.

But beneath the glamor, there lies a hidden world of immense gamble and risk, for cryptocurrency is an extremely unpredictable currency.

During market booms, the value of crypto can appreciate up to the millions. During crashes, however, a broker’s entire investment may plummet to zero. The online market’s volatility puts the value of investments in constant flux. A Bitcoin worth $1000 one day could be worthless the next. Ninety percent of amateur investors lose their money this way.

Despite such a Catch-22, cryptocurrency’s popularity continues to skyrocket. Its promise of “quick money,” trumpeted by the media, has enticed (and consequently swindled) countless people. Many of these investors have lost millions, and have resorted to further digital speculation to earn back their losses. The risk of entering this self-destructive cycle is oft-ignored in favor of the potential profits — especially by financially insecure individuals.

So far, the 21st century has not sustained a healthy economy. Crises have repeatedly crashed businesses, with the recent COVID-19 pandemic producing around 114 million unemployed workers. Living costs have skyrocketed as well: 47% of Americans report that rising expenses are their biggest worry for future finances. The global economy’s series of trips and stumbles have left a devastating wake of broken livelihoods. In these tumultuous times, unconventional sources of income have been embraced.

Matt Danzico, a Barcelona-based designer and journalist, chose to embrace cryptocurrency. Struggling with his finances during the 2020 pandemic, he joined the virtual market as an experiment. Danzico’s venture quickly spiraled into an obsession. Then into addiction.

“I would have these sleepless nights… trying to get these charts out of my head,” Danzico said in an interview with the Economic Times. “I thought I was losing my mind.”

As for the financial damage done, he added reluctantly, “Years of money [were] won and lost in a very short amount of time.”

To aid addicts like Danzico, Tony Marini, a lead therapist at Castle Craig Hospital, runs a crypto-addiction rehab unit in Scotland. Despite the novelty of cryptocurrency, Marini has had to treat over 100 crypto-addicts in the span of a few years — a worrying indicator of the issue’s terminal growth. He likens the volatile asset to a drug.

“Cryptocurrency is the crack cocaine of gambling,” he explains to the BBC in an interview. “It’s on your phone, your laptop, it’s in your bedroom. It’s 24/7.” Indeed, the accessibility of cryptocurrency is one of the biggest contributors to its culture of gambling. All an investor needs is a device and Wi-Fi to bet their lives away. Coupled with the world’s financial downturn, the appeal of online investment has grown exponentially. But consequently, the drawbacks have been glossed over.

Worryingly enough, the media has become engrossed by the virtual market’s high-stakes rewards. Nowadays, social platforms like Instagram are filled with influencers-turned-investors, who enthusiastically vouch for cryptocurrency’s legitimacy. In an unforgettable tweet last year, Elon Musk — CEO of Tesla Motors and SpaceX — promised to send “Dogecoin up to the moon.” All promotions share a commonality: none of them acknowledges the potential pitfalls of cryptocurrency.

Consequently, enthusiasts have been compelled to blindly invest in digital finance. Musk’s tweet drew a sudden influx of supporters to buy Dogecoin, causing the penny asset’s value to soar temporarily by 216%. An online forum named “r/wallstreetbets” also appeared on the discussion site Reddit, purely dedicated to risky financial deals. Members as young as thirteen praise influencers like Musk, and often bet thousands on cryptocurrency.

Similar to any narcotic, cryptocurrency’s infamy has only been bolstered by media coverage. The temporary “high” it gives lucky investors in the form of successful investments also heightens its appeal, especially amongst those of lower economic status. However, cryptocurrency’s devastating reverberations on lifestyle and mental health must be recognized as urgent problems. When crypto-addiction is formally accepted as an issue we will have taken a step forward.